Bank Stress Test 2025 Framework Meaning

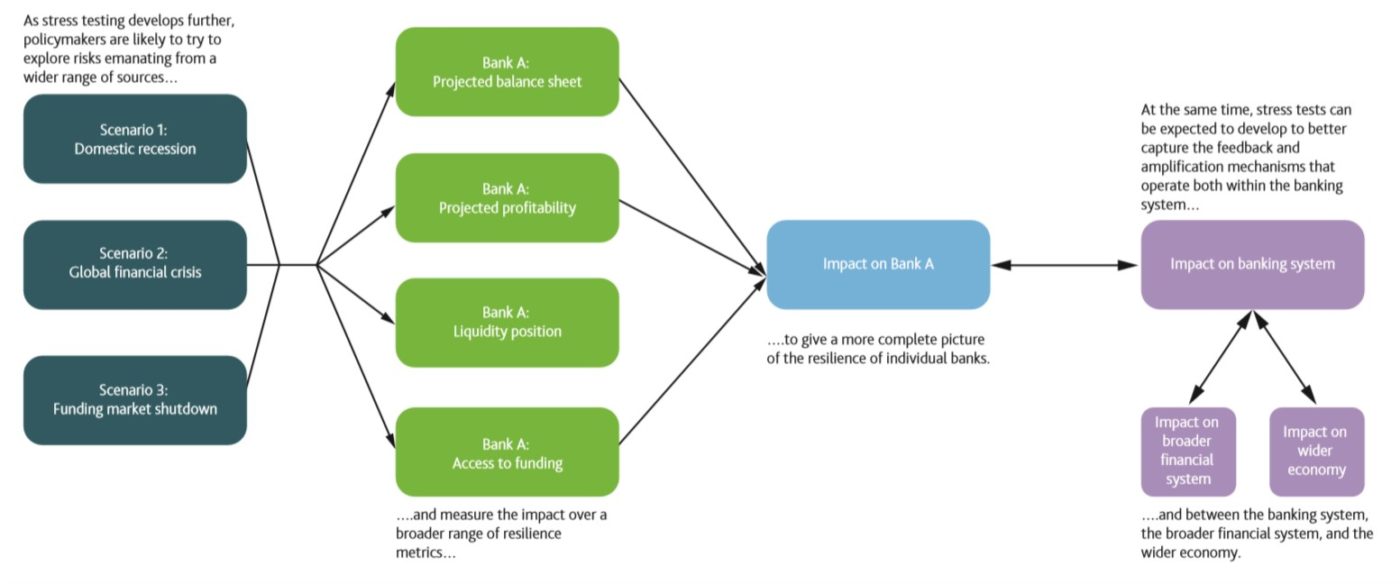

Bank Stress Test 2025 Framework Meaning - Stress Testing of Bank App Easy with Custom Software Altamira, Under the “stress test” exercise, the fed tests big banks. The stress test estimates how much each bank would lose under two hypothetical shocks: Stress Testing Banks AnalystPrep FRM Part 2 Study Notes, The exercise will assess how banks respond to and recover from a cyberattack, rather than their ability to prevent it. A key objective of the bank’s approach to stress testing is to ensure that banks can withstand severe adverse shocks, while also adequately supporting the real economy through those shocks.

Stress Testing of Bank App Easy with Custom Software Altamira, Under the “stress test” exercise, the fed tests big banks. The stress test estimates how much each bank would lose under two hypothetical shocks:

All major us banks pass federal reserve’s 2025 ‘stress test’.

(PDF) Bank Stress Testing A Stochastic Simulation Framework, It is well above the required minimum of 4.5%. Each year the federal reserve imposes a binding capital charge on the nation’s largest 32 banks, based on a stress test.

Stress Testing A Comprehensive Guide to Managing Risk Stress, Federal reserve on thursday released scenarios for its annual bank health checks that will assess how well 32 large lenders would fare under a severe. The stress test estimates how much each bank would lose under two hypothetical shocks:

Risks Free FullText Bank Stress Testing A Stochastic Simulation, The stress test estimates how much each bank would lose under two hypothetical shocks: European banking supervision uses stress tests to assess how well banks are able to cope with financial and economic shocks.

Bank Stress Test Definition, Example, How it Works?, The severely adverse scenario and global market shock component, which are used to calculate large banks’ stress capital charge. Each year the federal reserve imposes a binding capital charge on the nation’s largest 32 banks, based on a stress test.

A bank stress test determines how well a bank might withstand an economic crisis such as the one that struck the world after the 2008 financial crisis. A bank stress test is an analysis conducted under hypothetical scenarios designed to determine whether a bank has enough capital to withstand a negative economic shock.

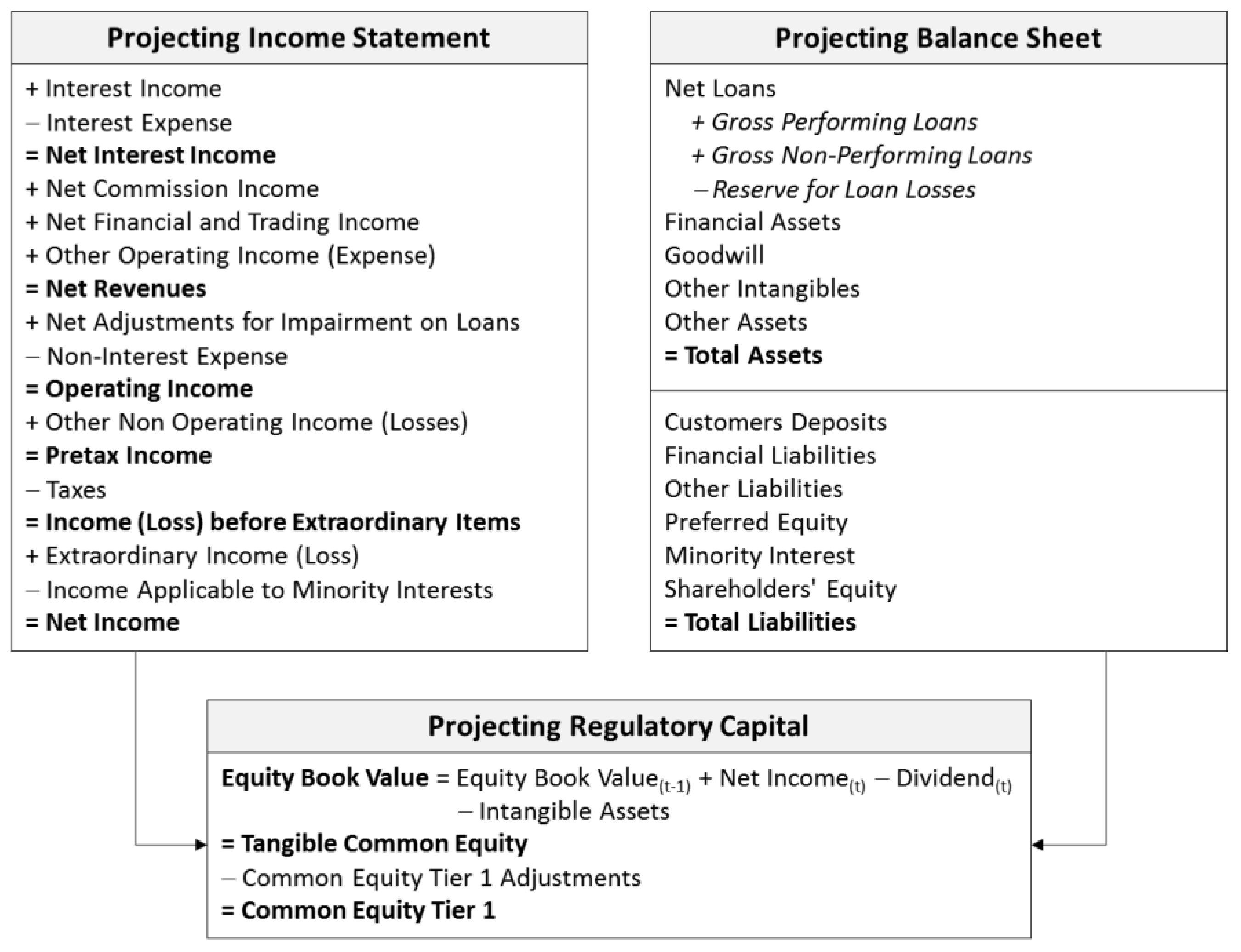

Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements. It is well above the required minimum of 4.5%.

Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements.

Stress Test Financial Risk Management An Essential Tool for Building, The central bank also noted that under stress, the aggregate cet1 capital ratio is anticipated to fall 280 basis points from 12.7% to 9.9%. The european central bank (ecb) will conduct a cyber resilience stress test on 109 directly supervised banks in 2025.

Bank Stress Test Definition, Example, How it Works?, A macroeconomic shock and (for nine trading banks only) a market shock. Federal reserve is due to release the results of its annual bank health checks on wednesday at 4:30 p.m.

Stress testing banks, All major us banks pass federal reserve’s 2025 ‘stress test’. The stress test was broadly similar to last year and modeled a severe global recession which caused a 40 per cent decline in commercial real estate prices, a 36 per cent fall in house prices, and a sharp spike in the unemployment rate.

What is stress testing? Definition and meaning Market Business News, A bank stress test is an analysis conducted under hypothetical scenarios designed to determine whether a bank has enough capital to withstand a negative economic shock. Learn the differences between scenario and sensitivity testing.

The stress test estimates how much each bank would lose under two hypothetical shocks:

The european central bank (ecb) will conduct a cyber resilience stress test on 109 directly supervised banks in 2025.